Opportunity Qualification Process and Criteria: How to Drive Sales with an Effective Strategy

Michael Edwards

This post was originally published in May 2020 and has been updated for accuracy and comprehensiveness.

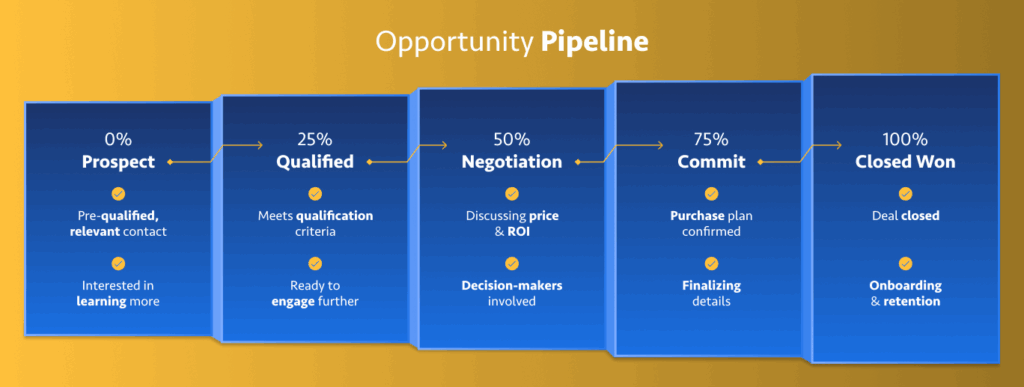

Your business’s opportunity qualification process and criteria should go beyond assessing whether a prospect has a genuine need for your solutions. To keep your sales pipeline active, you must also identify prospects with a strong likelihood of making a purchase.

Naturally, this is easier said than done. Even in B2B environments, sales depend on human behavior, which is often unpredictable. However, with proven processes and well-defined qualification criteria, your team can confidently navigate even the most complex qualification challenges.

In this chapter, you will gain a clear understanding of lead qualification and discover how to leverage that insight to accelerate the qualification stage of your sales pipeline.

The Essential Guide to Sales Pipeline Management

Learn our strategic approach to tracking prospects throughout the pipeline, forecasting revenue, and closing more deals.

What is lead qualification?

Lead qualification is the first step in the opportunity qualification process, where inbound or outbound leads are evaluated to determine whether they fit your ideal customer profile, laying the groundwork for more detailed evaluation and higher close rates.

Once a lead is deemed qualified (usually becoming a Sales-Qualified Lead, or SQL), it can move into opportunity qualification, through which it can be further assessed as a potential Sales-Qualified Opportunity (SQO).

Understanding sales-qualified leads (SQLs) vs. sales-qualified opportunities (SQOs)

Understanding the difference between SQLs and SQOs is crucial to running a successful sales pipeline. SQLs represent the early stage — prospects who have shown interest and meet basic qualification criteria — while SQOs are closer to a purchasing decision, signifying a deeper level of engagement and actively evaluating solutions.

| Sales-qualified leads | Sales-qualified opportunities |

|---|---|

| In the early stage of sales engagement | Actively in the sales pipeline |

| Have been vetted and meet your basic qualification criteria, such as budget, authority, need, and timeline | Have progressed into active sales discussions, demonstrated a clearly defined business need, and shown intent to make a purchasing decision |

| Demonstrate potential and are ready for meaningful sales conversations | Are ready to be moved toward closing a deal |

Moving SQLs down the pipeline to become SQOs is often a time-consuming process that demands a strategic balance of qualification and relationship-building, which can pull focus from closing-ready deals. That is where Sales Development Representatives (SDRs) play a critical role.

Qualifying prospects with sales development representatives

B2B companies commonly rely on sales development representatives (SDRs), a specialized sales role focused on prospecting and qualifying SQLs on behalf of closing reps. SDRs play a crucial role in driving pipeline growth by identifying high-potential leads. In fact, according to The Bridge Group, a single SDR in the SaaS industry generates an average of $3 million in sales pipeline annually.

An SDR team accelerates the sales cycle by bridging the gap between qualified leads and qualified opportunities, while enabling your closing reps to concentrate on prospects already deeper in the pipeline. But how exactly do they do that?

Subscribe to EBQ's Bimonthly Newsletter

Subscribe to EBQ's Bimonthly Newsletter

Determining your sales qualification criteria

To effectively qualify an opportunity, SDRs evaluate whether a prospect meets predefined sales qualification criteria. These criteria are based on how well the prospect aligns with the company’s product offering, sales strategy, and overall business objectives. This assessment relies on thorough discovery, which reveals key insights into the prospect’s environment, pain points, and readiness to engage in the buying process.

One common qualification criterion is the timeframe. Specifically, how soon the prospect intends to implement a solution. For instance, if your average sales cycle supports a six-month decision window, a prospect planning to purchase within that timeframe may be considered qualified. In contrast, companies with shorter sales cycles might only qualify prospects who are prepared to decide within 30 to 60 days.

- Budget: Does the prospect have the financial resources allocated to invest in your solution?

- Authority: Is the contact a decision-maker or directly involved in the purchasing process?

- Need: Do they have a clear business problem or challenge that your offering addresses?

If a prospect meets your opportunity qualification criteria, move them into the qualified stage of your pipeline. At this point, the lead is typically assigned a 25% probability of closing, helping improve forecast accuracy and allowing your team to focus on the most promising opportunities.

Exclude them from your active pipeline if they do not meet the criteria. Prospects who show potential but lack budget or timing alignment should be placed in a nurture cycle, where your team can maintain the relationship until they are ready to re-engage.

Effective methodologies for qualifying sales opportunities

There are multiple sales qualification methodologies available, each offering a unique approach to evaluating prospects. Sales methodologies offer a structured framework to guide how your sales team engages and qualifies leads. The widely adopted approaches outlined below can help you quickly establish effective opportunity qualification criteria.

BANT Sales Qualification

One of the most well-known qualification methodologies is BANT, which stands for Budget, Authority, Need, and Timeframe. Developed by IBM in the 1950s, BANT is a longstanding framework that focuses on the fundamental elements of a sales opportunity.

MEDDIC Sales Process

Another widely recognized qualification methodology is MEDDIC, which stands for Metrics, Economic Buyer, Decision Criteria, Decision Process, Identify Pain, and Champion. Originally developed in the 1990s for enterprise software sales, MEDDIC is a comprehensive framework designed to navigate complex B2B sales by focusing on the factors that drive purchasing decisions.

FAINT Qualification Framework

The FAINT qualification framework is another valuable approach, which stands for Funds, Authority, Interest, Need, and Timing. Developed by The RAIN Group as a more nuanced alternative to traditional methods, FAINT focuses on understanding the buyer’s level of interest and readiness, making it particularly useful for long sales cycles and complex deals.

CHAMP Sales Qualification

The CHAMP sales qualification methodology is another effective approach, standing for Challenges, Authority, Money, and Prioritization. This framework focuses on understanding the buyer’s specific challenges and aligning your solution with their needs, making it ideal for consultative sales processes that prioritize customer problems and solutions.

Comparison of Sales Qualification Models

| Method | BANT | MEDDIC | FAINT | CHAMP |

|---|---|---|---|---|

| Key Components | Budget, Authority, Need, Timing | Metrics, Economic Buyer, Decision Criteria, Decision Process, Identify Pain, Champion | Funds, Authority, Interest, Need, and Timing | Challenges, Authority, Money, and Prioritization |

| Ideal Use | Quick qualification for transactional sales | Complex B2B sales with multiple stakeholders | Ideal for complex sales processes where the buying decision takes time | Consultative sales focusing on the buyer’s problems |

| PROS | Simple and fast | Structured and thorough | Flexible and scalable | Emphasizes the buyer’s perspective |

| CONS | May overlook deeper buyer needs | Best suited for large enterprises | Not suitable for quick sales | May require longer qualification time |

The Essential Guide to Sales Pipeline Management

Learn our strategic approach to tracking prospects throughout the pipeline, forecasting revenue, and closing more deals.

Master lead qualification with EBQ

Effective opportunity qualification is a cornerstone of a successful sales strategy. By implementing a structured qualification process, sales teams can ensure they focus their efforts on prospects with the highest potential for conversion.

At EBQ, we recognize that no single qualification framework fits all scenarios. Our Appointment Setting services adopt a blended approach, integrating elements from various methodologies to create a tailored process that aligns with our clients’ specific needs and dynamics, which ultimately drives more predictable and successful sales outcomes.

About the Author:

Michael Edwards is one of the founding members of EBQ and currently serves as EBQ’s VP of Sales, where his intersection of sales strategy and people management has fueled his success in scaling teams across all industries. With more than 20 years of experience, he has worked on hundreds of projects and is a master at identifying how to run effective sales operations.