How to Create Personas from Data

Tom Brinker

This post was originally published in May 2019 and has been updated for accuracy and comprehensiveness.

Understanding your customers is crucial to fueling any personalized marketing campaigns. One of the most effective ways to comprehend who you are targeting is mastering how to create personas from data.

In this chapter, we’ll go over:

- What does ICP stand for in marketing?

- ICP vs buyer persona

- 2 approaches to persona research

What you learn about your customers becomes elements of account-based marketing (ABM). ABM is a strategic approach to B2B marketing that targets specific company accounts and the individual prospects in the organization that are involved in purchasing decisions. Having a clear picture of your ideal customers helps you avoid wasting your marketing and sales budget or even building a list of unsuitable target accounts and prospects.

B2B Marketing Strategy Framework: The Ultimate Guide to Business Branding

Learn how to build a strong brand experience with our downloadable guide.

What does ICP stand for in marketing?

ICP stands for “ideal customer profile,” which describes the firmographic and technographic attributes of your target prospect’s company.

Firmographic: Industry, company size, revenue, geographic location

Technographic: Relevant tools in their tech stack

In any lead generation outreach campaign, firmographic and technographic information are key information to help weed out unqualified prospects. It will also make it easier for your data vendor to pinpoint relevant contact data information for both your sales and marketing team.

ICP vs. Buyer Persona

While ICP describes your prospective company’s overall qualifying attributes, buyer personas describe the individuals that typically make up your prospects’ buying committee.

A few examples of key information to record include:

- Job titles

- Seniority level

- Role in the purchasing decision process

We wrote an in-depth article on the 10 components of a well-defined B2B buyer persona. Check it out if you need additional pointers on how to develop your own buyer persona.

ICPs and buyer personas inform your marketing team not only how to personalize their marketing campaigns, but also who to target your marketing messages to.

Subscribe to EBQ's Bimonthly Newsletter

Subscribe to EBQ's Bimonthly Newsletter

2 Approaches to Persona Research

As you start to research and develop your ICP and personas, ask yourself:

- Do I have a large enough customer database to draw accurate insights from?

This will ultimately determine which approach you’ll take for persona research.

Approach 1: Working with existing data

This approach is for those who have a large enough existing customer base to draw insightful conclusions.

Step 1: Identify data sources

Figure out where to pull existing customer data from, such as:

Your existing sales funnel

Website visitors

Your database

Sales calls

Step 2: Discern patterns

Look at your top buyers and ask yourself the following starting questions:

- Who has purchased your product?

- Which methods of targeting and segmenting have worked in the past?

- What are common pain points these buyers are facing?

- Who can afford your solution?

- Where can you service your solution?

Take these answers, turn them into a coherent metric, and use the trends in your data to build out your customer profiles.

Approach 2: Starting from scratch

Maybe you’ve yet to build a large enough customer base from which you can pull this data. Your focus should still be on gathering the most reliable information for defining your ideal buyers.

You can use credible third-party data about your industry and solutions like yours as a starting point, then supplement it with primary data about your specific buyers.

Step 1: Solicit feedback

For a full 360˚ picture of your current customers, you’ll want to interview and request feedback from both your internal team and current buyers.

You could do the following:

- Conduct one-on-one or group interviews with customers or your suspected personas

- Develop online surveys targeted at possible personas (offering incentives to complete these research surveys works well too)

- Use sales development reps for cold outreach to speak directly with leads and validate suspected markets

- Request feedback from sales teams about conversations they’ve had with prospects and customers

- Solicit insight and feedback from the product team about buyers’ needs and common pain points in the market

While speaking to your current customers is helpful, you shouldn’t discount your internal team’s input. Salespeople and SDRs spend their time trying to better understand your buyers in order to sell to them better, so they have a unique big-picture perspective on what an ideal customer looks like.

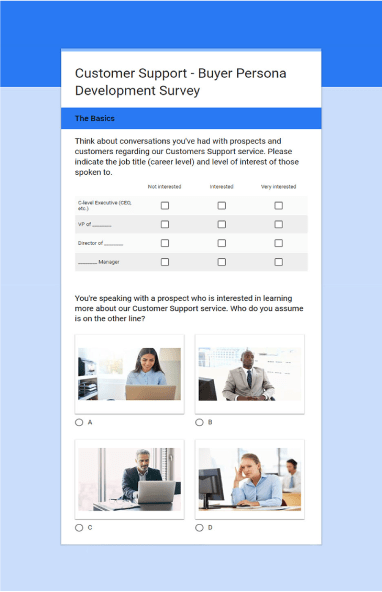

Here’s an example survey created in Google Forms that we use to poll our sales teams and get an idea of the ideal buyers for our outsourced Customer Service offering.

Step 2: Gather qualitative feedback

Gathering qualitative data about buyers’ goals, challenges, and decision drivers is crucial for fully understanding how you should speak to them through your marketing.

In the example persona survey pictured above, the second question uses stock images to represent possible buyers, and it’s not included thoughtlessly. It actually provides valuable insight into the perception of our buyers, their personality types, and their level of professionalism.

Aim to gain this type of insight when performing research directly with customers and prospects also.

Some qualitative insights you could investigate include:

- How do they prefer to communicate (over the phone, through email, via live chat, etc.)?

- How many people at the company are involved in purchase decisions?

- Which applications make up their current technology stack (you can use tools like BuiltWith to find this information)?

Step 3: Consult reliable third-party research

As mentioned earlier, utilize credible third-party data about your industry and solutions like yours as a starting point, then supplement it with primary data about your specific buyers.

You can use their insight to develop data-driven marketing strategies.

That said, you’ll want to be aware of their data quality. Otherwise, you could be bleeding resources trying to connect with prospects who are unlikely to convert.

B2B Marketing Strategy Framework: The Ultimate Guide to Business Branding

Learn how to build a strong brand experience with our downloadable guide.

TLDR; How to perform client persona research

In this Chapter, we discussed:

- What does ICP stand for in marketing?

- ICP vs buyer persona

- 2 approaches to persona research

As mentioned earlier, your approach on how to create personas from data heavily depends on the size of your current customer database.

If you’re struggling to create effective marketing campaigns, consider partnering with EBQ. Our built-in management layer allows us to manage your dedicated marketing team and align your campaigns with your overall business goals. Visit our Full-Service Marketing Agency page to learn more.